Life Insurance Corporation of India (LIC) is the largest and leading Life Insurance provider company in India. Founded in the year 1956; LIC is headquartered in the city of Mumbai, India. It is under the ownership of the Government of India. LIC has the most trusted brand in the public for Life Insurance, with a market share of above 66% in new Business Premium. And fifth-largest global insurer by GWP (Gross Written Premium).

LIC Promoter & Key management People:

The President of India, acting through the ministry of Finance, Government of India is the company Promoter.

- M R Kumar (Chairperson)

- B C Patnaik (Managing Director)

- Smt. Ipe Mini (Managing Director)

- Siddharth Mohanty (Managing Director)

- Rajkumar (Managing Director)

Major Products of LIC:

- Life insurance – Endowment Plan

- Term Life Insurance Plan

- Investment with a Guaranteed Return Plan

- Annuity & Pension Plan

Distribution Strategy of LIC:

- LIC has over 13,50,000+ agents who bring most of the new business.

- LIC has over 2,048+ Branches across Pan India, including divisional offices and Satellite offices. And Employee’s Strength of 1,14,498 as of March 2020.

- LIC operates globally in Nepal, Bangladesh, Singapore, Sri Lanka, Fiji, Mauritius, UAE, Bahrain, Qatar, Kuwait, and the United Kingdom.

Holdings of LIC India:

LIC is Invested in various sectors and holds its major stake in the Nifty companies like;

ITC: Rs.27,326 crores;

RIL: Rs.21,659 crores,

ONGC: Rs.17,764 crores,

SBI: Rs.17,058 crores,

L&T Rs.16,800 crores and

ICICI Bank: Rs.10,006 crores the above-estimated values as of 2012.

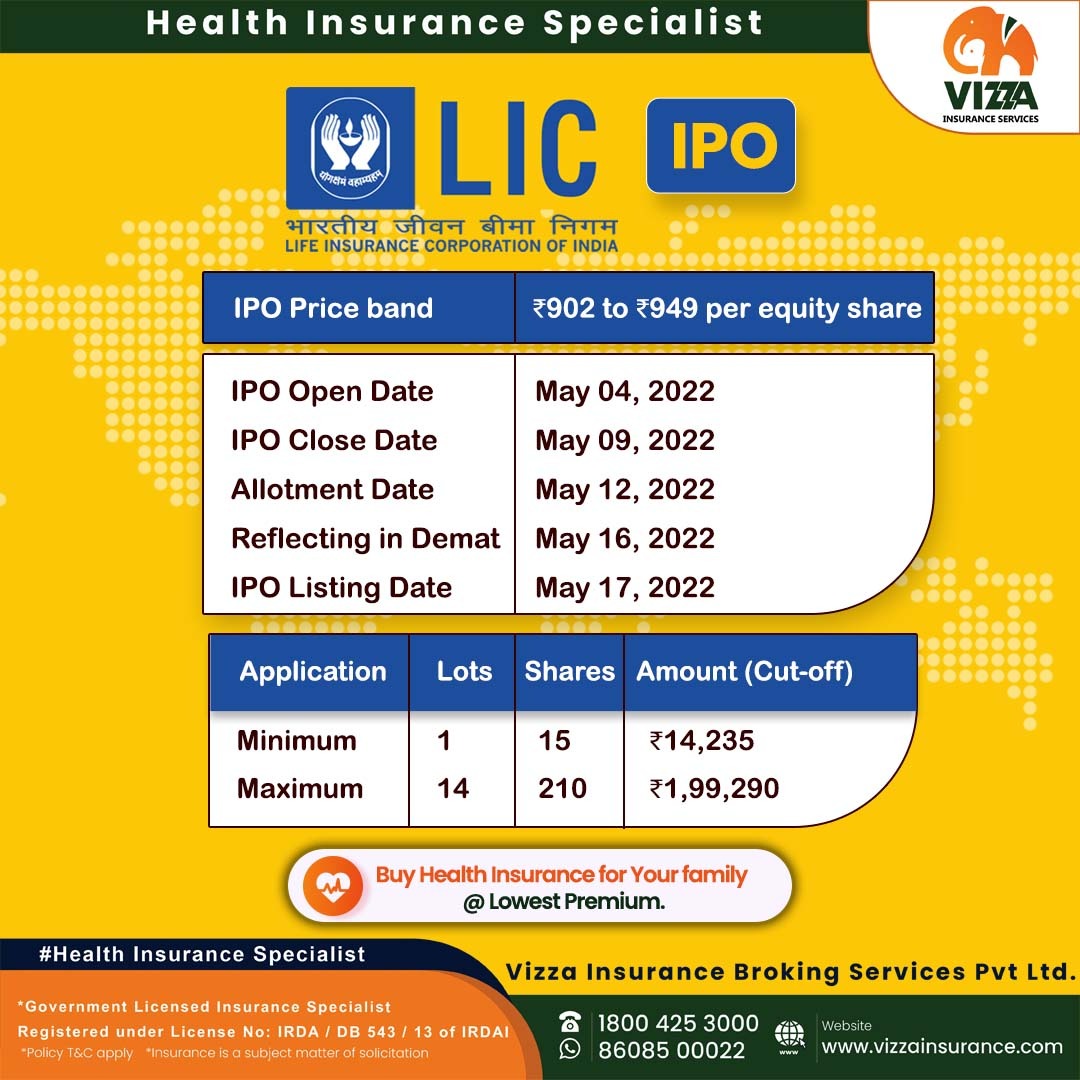

LIC IPO Details

| IPO Opening Date | May 4, 2022 |

| IPO Closing Date | May 9, 2022 |

| Issue Type | Book Built Issue IPO |

| Face Value | Rs.10 per equity share |

| IPO Price | Rs.902 to Rs.949 per equity share |

| Market Lot | 15 Shares |

| Min Order Quantity | 15 Shares |

| Listing At | BSE, NSE |

| Issue Size | 221,374,920 Equity Shares of Rs.10 (aggregating up to Rs.21,008.48 Cr) |

| Offer for Sale | 221,374,920 Equity Shares of Rs.10 (aggregating up to Rs.21,008.48 Cr) |

| Retail Discount | Rs 45 per share |

| Employee Discount | Rs 45 per share |

| QIB Shares Offered | Not more than 50% of the Net Offer |

| Retail Shares Offered | No less than 35% of the Net Offer |

| NII (HNI) Shares Offered | No less than 15% of the Net Offer |

LIC IPO: Timetable

The bidding time is 10.00 A.M. to 5.00 P.M.

| IPO Opening Date | May 4, 2022 |

| IPO Closing Date | May 9, 2022 |

| Basis of Allotment | May 12, 2022 |

| Reflecting in Demat | May 16, 2022 |

| IPO Listing Date | May 17, 2022 |

LIC IPO Lot Size

| Application | Lots | Shares | Amount (Cut-off) |

|---|---|---|---|

| Minimum | 1 | 15 | Rs.14,235 |

| Maximum | 14 | 210 | Rs.199,290 |

LIC IPO Promoter Holding

| Pre Issue Share Holding | 100% |

| Post Issue Share Holding | 96.50% |

LIC IPO Effective Price by Category

| Investor Category | Effective Price |

|---|---|

| QIBs | Rs.949 |

| HNIs | Rs.949 |

| Retail | Rs.904 (Rs 45 discount) |

| Policyholders | Rs.889 (Rs 60 discount) |

T.S.Vignesh Karthik

(The author can be contacted at vignesh@vizzafin.com & Call: +91-9047078809)